Cash Flow Overview

- Jefferson Firmino Mendes

- 18 de jun. de 2024

- 5 min de leitura

Atualizado: 21 de jul. de 2024

Summary:

Cash Flow: A Vital Tool for Financial Success

Cash flow is an essential tool in the financial management of any business or individual. It represents the record of all money inflows and outflows over a specific period.

This practice provides a clear view of financial health, identifying investment opportunities, avoiding liquidity issues, and ensuring long-term financial sustainability.

Origin and Purpose of Cash Flow

The concept of cash flow emerged in the field of financial accounting in the early 20th century, with the pioneering work of economists and accountants. However, its importance was widely recognized only in the following decades, especially after the Great Depression of 1929, when companies realized the need for stricter financial control to avoid crises.

Prominent precursors of cash flow include John Maynard Keynes, considered the father of modern macroeconomics, and Henry Gantt, known for developing the Gantt chart, a planning tool that also influenced financial management.

Cash Flow Control with Excel

Excel is a powerful tool for cash flow management. With its ability to organize data, perform complex calculations, and create dynamic charts, Excel allows detailed analysis and clear visualization of finances. Creating cash flow models in Excel facilitates tracking cash inflows and outflows, identifying trends, and areas for improvement.

Application of Excel in Small Business Cash Flow Control

Excel is essential for effective cash flow control in small businesses, such as a neighborhood grocery store. It offers powerful features to organize financial data, perform complex calculations, and create clear and informative visualizations.

Below is a generic Excel spreadsheet demonstrating the cash inflows and outflows of a small business over a month:

Cash Flows

Date | Description | Inflows (R$) | Outflows (R$) | Balance (R$) |

01/03/2024 | Product Sales | 1500.00 | 1500.00 | |

05/03/2024 | Stock Purchase | 600.00 | 900.00 | |

10/03/2024 | Supplier Payment | 400.00 | 500.00 | |

15/03/2024 | Product Sales | 1800.00 | 2300.00 | |

20/03/2024 | Salary Payment | 800.00 | 1500.00 | |

25/03/2024 | Maintenance Expenses | 200.00 | 1300.00 | |

31/03/2024 | Product Sales | 1600.00 | 2900.00 |

In this generic spreadsheet, we record the cash inflows and outflows throughout March 2024 for a neighborhood grocery store.

Inflows are recorded when the store receives money from sales, while outflows are recorded when the business makes payments for expenses such as stock purchases, supplier payments, salaries, and maintenance expenses.

Advantages of Using Excel

The balance is updated after each transaction, providing a clear view of the business's financial liquidity.

Using Excel for cash flow control offers several advantages, including:

Data Organization: Data is structured in cells and columns, facilitating visualization and manipulation.

Automated Calculations: Excel formulas and functions allow automatic calculation of balances, totals, averages, and other important metrics.

Graphical Visualizations: Dynamic charts and tables can be created to visualize financial trends over time, aiding decision-making.

Ease of Updating: The spreadsheet can be easily updated with new transactions, ensuring information is always current and accurate.

Therefore, Excel plays a fundamental role in cash flow control, helping entrepreneurs manage their finances efficiently and make informed financial decisions for their business success.

Types of Cash Flow

There are two main approaches to cash flow: direct and indirect.

Direct Cash Flow: In this approach, all cash inflows and outflows are recorded directly, providing an immediate view of financial liquidity.

Indirect Cash Flow: Here, changes in the cash balance are calculated from net income, adjusted for non-monetary items and changes in assets and liabilities.

Examples of Direct and Indirect Cash Flow:

Direct Cash Flow:

Description | Inflows | Outflows |

Salary | R$ 3,000 | |

Rent | R$ 1,200 | |

Electricity Bill | R$ 150 | |

Supermarket | R$ 500 | |

Transportation | R$ 200 | |

Internet and Cable TV | R$ 180 | |

Leisure | R$ 300 | |

Total | R$ 3,000 | R$ 2,530 |

Final Balance | R$ 470 |

Indirect Cash Flow:

Description | Amount |

Net Profit | R$ 2,000 |

Depreciation | R$ 300 |

Change in Inventory | R$ -100 |

Late Customer Receipt | R$ 500 |

Late Supplier Payment | R$ -200 |

Loan Payment | R$ -400 |

Total | R$ 2,600 |

Initial Balance | R$ 500 |

Final Balance | R$ 3,100 |

Fluxo de Caixa e Banco Imobiliário

Cash Flow and Monopoly

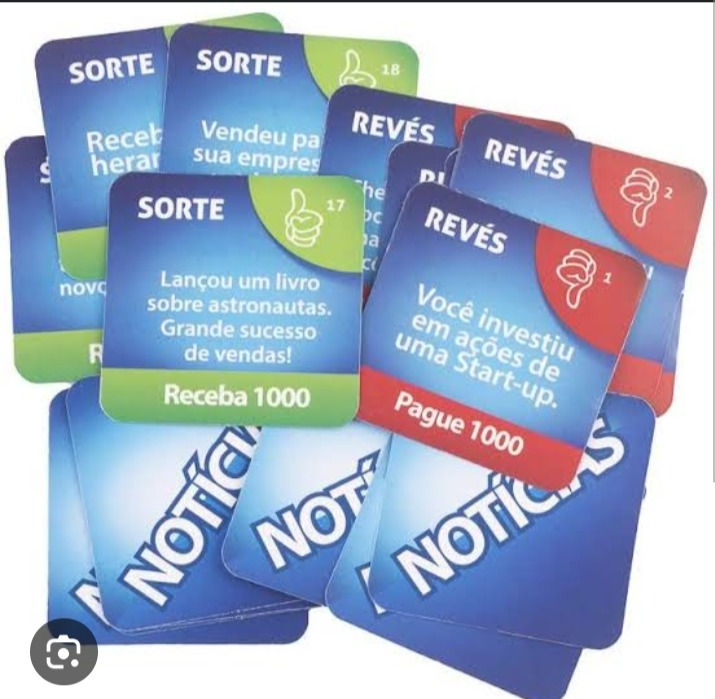

A creative way to introduce the concept of cash flow is through the Monopoly game. In the game, players learn about the importance of managing their finances, making investment decisions, and dealing with financial contingencies.

Robert T. Kiyosaki, author of "Rich Dad Poor Dad," popularized the concept of cash flow through his book and the game Cashflow, which simulates real-world financial situations.

Here are some examples of adapted moves and rounds from Monopoly that can encourage and captivate learning about cash flow:

1. Chance or Community Chest Cards:

When a player draws a "Chance" card, they may receive an unexpected amount of money, such as "You won R$ 500 in a community raffle." This teaches players to handle unexpected cash inflows.

Conversely, if a player draws a "Community Chest" card, they may have to deal with an unexpected expense, such as "Your car broke down. Pay R$ 200 in repairs." This teaches players to consider unforeseen expenses in their cash flow.

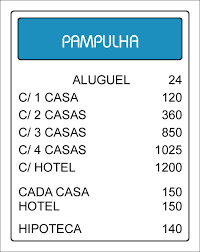

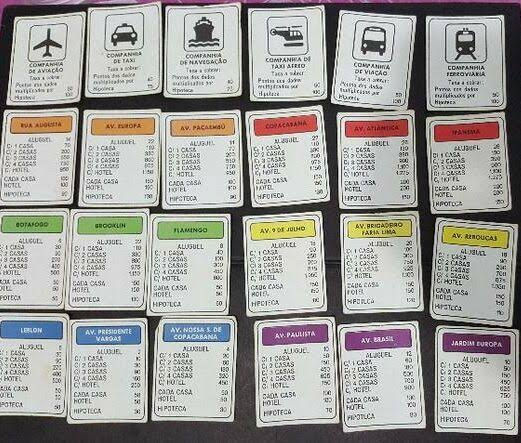

2. Property Purchase:

When buying a property, players must consider not only the initial cost but also ongoing costs such as taxes, maintenance, and mortgage. This teaches them to plan their future expenses and consider how these costs will affect their cash flow over time.

3. Rent and Rent Collection:

When a player owns properties, they can earn money from rents. This teaches players about the importance of regular cash inflows in their cash flow.

Similarly, when a player lands on another player's property, they must pay rent. This teaches players about regular cash outflows and the importance of reserving funds for these payments.

4. Property Sale:

Players can choose to sell their properties to obtain a quick cash influx. This teaches players about managing their cash flow and making strategic decisions about when to sell assets to get money.

5. Mortgage Properties:

In times of financial difficulty, players can choose to mortgage their properties to get immediate cash. This teaches players about the consequences of taking loans and how these decisions affect their long-term cash flow.

6. Importance of Dashboards and Graphical Visualizations:

Players can choose to invest in improvements to their properties to increase rental value. This teaches players about investing in their business to increase cash inflows and improve cash flow.

These adapted Monopoly examples can make learning about cash flow more engaging and practical, allowing players to experience real-world financial situations in a fun and educational way.

Importance of Dashboards and Graphical Visualizations

Creating dashboards and graphical visualizations of cash flow data is crucial for a quick and effective understanding of the financial situation.

By comparing metrics by month, periods, and year, managers can identify seasonal patterns, growth trends, and areas of concern.

The main difference between viewing this data in a monochromatic notebook and an Excel spreadsheet lies in the ability to analyze and interpret the data. While the notebook offers a static and limited view, Excel allows for dynamic data manipulation and analysis, preparing it for more advanced tools like Power BI, which offers predictive analysis and interactive visualization capabilities.

In summary, cash flow is a vital tool for financial success, providing a clear view of financial health and guiding strategic decisions. With the support of tools like Excel and Power BI, managers can enhance financial control, maximize profits, and ensure long-term sustainability.

Bibliographic Sources

Books:

"Rich Dad Poor Dad" by Robert T. Kiyosaki (2000)

"The Cashflow Quadrant: Rich Dad's Guide to Financial Freedom" by Robert T. Kiyosaki (2011)

"The Effective Executive" by Peter Drucker (1967)

"Analysis for Financial Management" by Richard A. Brealey, Stewart C. Myers, and Franklin Allen (2017)

"Financial Accounting" by Atílio Altenhofen (2020)

Articles:

"The Importance of Cash Flow for Business Success" by Sebrae (2023)

"How to Use Cash Flow for Better Financial Decisions" by Warren Buffett (2019)

"Cash Flow Control: A Comprehensive Guide for Small Businesses" by BNDES (2022)

"Cash Flow: The Ultimate Guide for Entrepreneurs" by Endeavor (2021)

"5 Tips for Creating an Effective Cash Flow" by ContaAzul (2023)

Websites:

Other Sources:

Generic Excel cash flow spreadsheet for a neighborhood grocery store (created by me)

Examples of adapted moves and rounds from Monopoly (created by me)

Comentários